The GST ARN, or Application Reference Number, is a crucial aspect of the GST (Goods and Services Tax) system in India. It is a unique 15-digit number assigned to applicants once they successfully submit their GST registration application on the GST portal. The ARN serves as an acknowledgment and a tracking tool, allowing applicants to monitor the progress of their GST registration application.

What is GST ARN?

GST ARN is a 15-digit number generated upon successfully submitting a GST application. This unique code enables applicants to monitor their registration status, ensuring a seamless experience in obtaining a GST identification number (GSTIN). The ARN is issued by the GST portal and provides real-time updates about the application’s progress.

Why is GST ARN Important?

- Application Tracking: GST ARN allows businesses to check the progress of their GST registration, from submission to approval or any required corrections.

- Proof of Application: It serves as a digital acknowledgment of your application submission.

- Compliance Assurance: Keeping track of GST ARN ensures you stay informed about your GST status, aiding in timely compliance.

GST ARN Status

The GST ARN Status refers to the progress or current state of an application submitted using the Application Reference Number (ARN) on the GST portal. Applicants can use their ARN to track the status of various GST-related applications, such as registration, amendments, or cancellations.

Steps to Check GST ARN Status:

- Visit the GST Portal: Go to www.gst.gov.in.

- Navigate to “Track Application Status”:

- On the homepage, click on the Services tab.

- Under the Registration section, select Track Application Status.

- Enter ARN:

- Enter the 15-digit ARN in the required field.

- Solve the CAPTCHA and click on Search.

- View Application Status:

- The portal will display the status of your application, which could be one of the following:

- Pending for Processing: The application is submitted and under review.

- Approved: The GST registration or requested change has been approved.

- Rejected: The application has been declined, with reasons mentioned.

- Pending for Clarification: The authorities have requested additional information or clarification.

- The portal will display the status of your application, which could be one of the following:

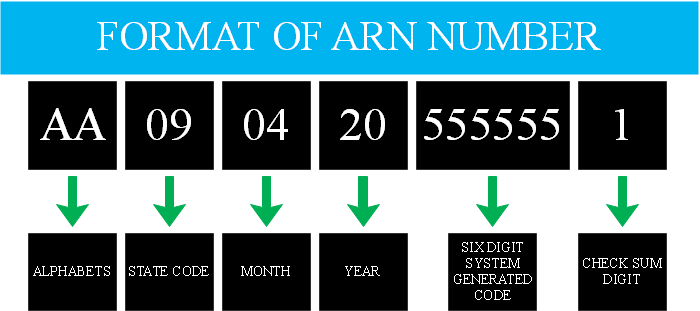

Structure of GST ARN Number

The GST ARN (Application Reference Number) is a 15-digit alphanumeric code uniquely assigned to track the status of a GST application. Each part of the ARN number has a specific meaning and purpose. Here’s a breakdown of its structure:

1. First Two Digits

- These represent the state code as per the Indian Census 2011.

- For example, “07” corresponds to Delhi, while “27” represents Maharashtra.

2. Next Two Digits

- These denote the year in which the ARN is generated.

- For instance, “23” would signify the year 2023.

3. Following Ten Characters

- This section comprises an alphanumeric system-generated code unique to each application.

- It ensures the distinct identity of every GST ARN.

4. Last Digit

- The final digit is a check code, used for error detection in the ARN.

Example of GST ARN Format

An example ARN could be: 07AA2023B1Z5

- 07: State Code (Delhi)

- AA: Year of Application (2023)

- 2023B1: Unique Identifier

- Z5: Check Code

Common Queries

1. How is GST ARN generated?

GST ARN is generated automatically after the successful submission of a GST application. You’ll receive the number via email or SMS.

2. Can I retrieve a lost GST ARN?

Yes, GST ARN can be retrieved by logging into the GST portal and checking your application history.

3. What should I do if my application is rejected?

If your GST ARN shows a rejected status, review the reasons for rejection provided on the portal and rectify the errors before resubmitting.

Conclusion

Understanding and using GST ARN effectively is crucial for businesses to stay GST-compliant. By tracking your application status and addressing issues promptly, you ensure a smooth registration process. Whether you’re a startup or an established enterprise, GST ARN simplifies your journey towards GST compliance.

For more insights and updates about GST, stay tuned!