In today’s competitive business landscape, having a GST number is not just a legal obligation—it’s also a key enabler for streamlined operations and enhanced credibility. As the Goods and Services Tax (GST) system continues to unify indirect taxes across India, businesses that fail to register risk penalties, missed opportunities for growth, and difficulties in working with GST-compliant partners.

Get in touch

What is a GST Number?

A GST number (Goods and Services Tax Identification Number) is a unique 15-digit identification number assigned to businesses registered under the GST system in India. It serves as a mark of authenticity and compliance for businesses dealing in goods and services.

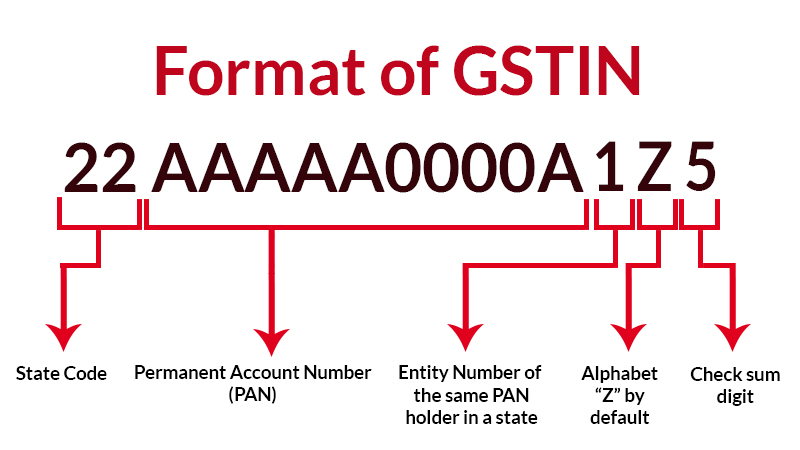

Structure of a GST Number

The GST number is structured to include details about the state, business type, and unique identifier:

- The first two digits represent the state code.

- The next ten digits are the PAN of the business.

- The 13th digit indicates the number of registrations under the same PAN in a state.

- The 14th digit is for internal use, and the last is a check code.

How to Get a GST Number

1. Check Your Eligibility

Before applying, confirm if your business needs GST registration:

- Turnover exceeds ₹20 lakhs for service providers or ₹40 lakhs for goods suppliers.

- You’re involved in interstate trade.

- You run an e-commerce business or are a casual taxable person.

2. Gather Required Documents

You’ll need the following documents:

- PAN card of the business or proprietor.

- Aadhaar card of the proprietor or partners.

- Proof of business address (electricity bill, rental agreement, etc.).

- Bank account statement or canceled cheque.

- Digital signature (for companies and LLPs).

- Certificate of incorporation or partnership deed (for registered entities).

3. Register on the GST Portal

- Visit the official GST portal: www.gst.gov.in.

- Click on “Services” > “Registration” > “New Registration.”

- Fill in the basic details like:

- Type of taxpayer (individual, company, etc.).

- State and district.

- Business name as per PAN.

- Email ID and mobile number for OTP verification.

4. Fill Out the Application

After initial registration:

- Log in with the Application Reference Number (ARN) sent to your email.

- Complete Part-B of the application form by providing:

- Business details.

- Promoter/partner information.

- HSN codes for goods or SAC codes for services.

- Proof of address and bank account details.

5. Upload Documents

Attach scanned copies of the required documents in the prescribed format and size.

6. Submit the Application

After completing the application:

- Verify the details using an OTP or digital signature.

- Submit the application.

7. Track Application Status

You’ll receive an ARN to track your application status on the GST portal.

8. Receive GST Number

Once your application is verified by the GST officer, you’ll receive your GST number and certificate via email.

At Gupta Pawan & Co., we’re committed to helping you through the GST registration process. If you have any questions or need assistance, don’t hesitate to contact us. We’re here to make your GST journey seamless and hassle-free.

Who Needs a GST Number?

Businesses and individuals engaged in the supply of goods and services need to register for GST if they meet any of these criteria:

- Turnover exceeds the prescribed threshold.

- Involved in interstate supply.

- Operating e-commerce platforms.

- Casual taxable persons or non-resident taxable persons.

Benefits of a GST Number

- Streamlined tax filing process.

- Access to a unified tax system.

- Eligibility to participate in B2B contracts and e-commerce platforms.

- Enhanced business credibility and trustworthiness.

Conclusion

A GST number is not just a legal requirement but also a tool to enhance your business’s efficiency and reputation. Whether you’re a startup or an established enterprise, registering for GST is a step toward better compliance and growth in the competitive marketplace.

Incorporate GST into your business strategy today and enjoy the numerous benefits it brings!